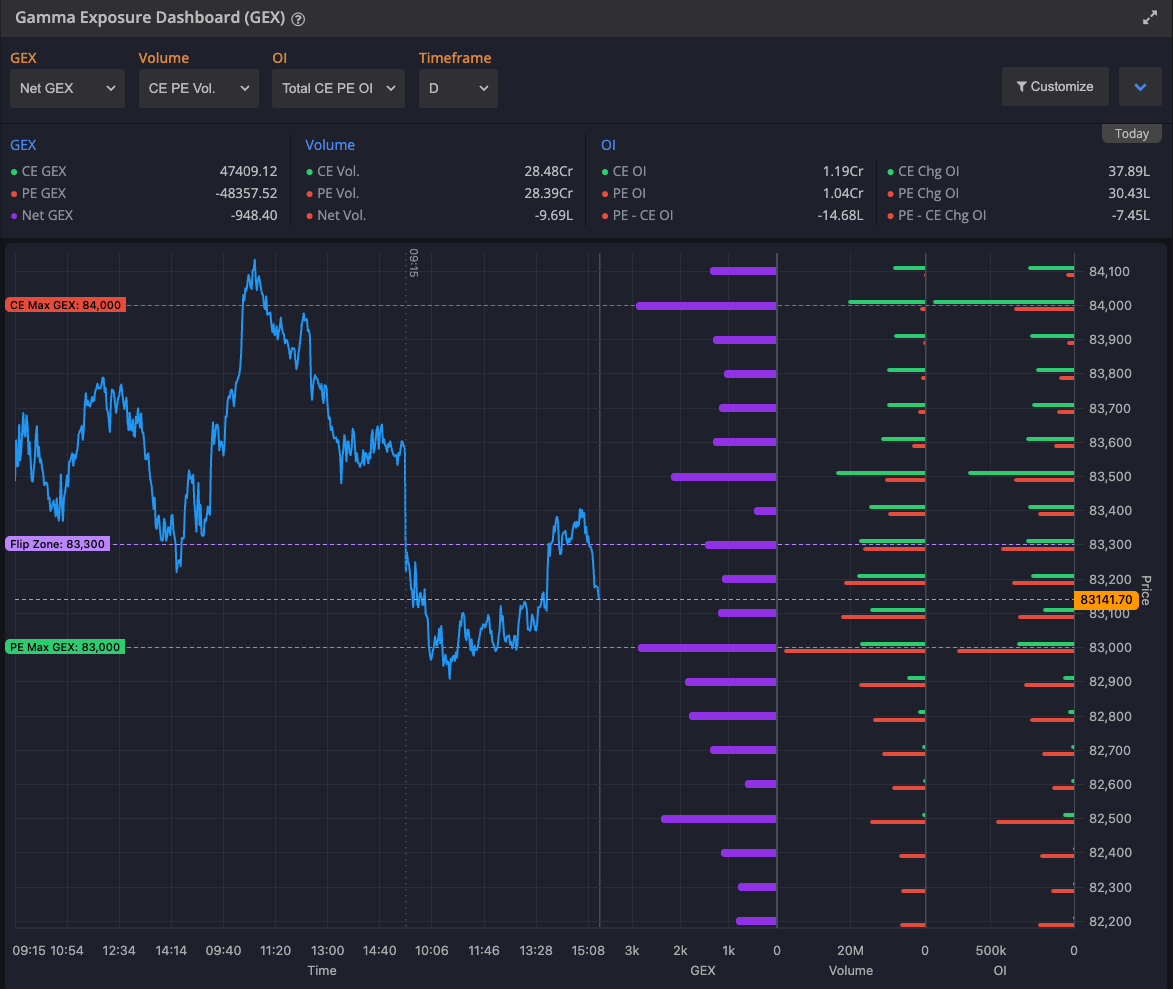

Gamma Exposure Dashboard pulls up volume, open interest, and gamma across multiple strikes for the same symbol.

Gamma Exposure

Gamma Exposure GEX Levels

GEX Levels Volume

Volume OI

OI Change OI

Change OI Different Timeframe

Different Timeframe Net Gamma Exposure

Net Gamma Exposure

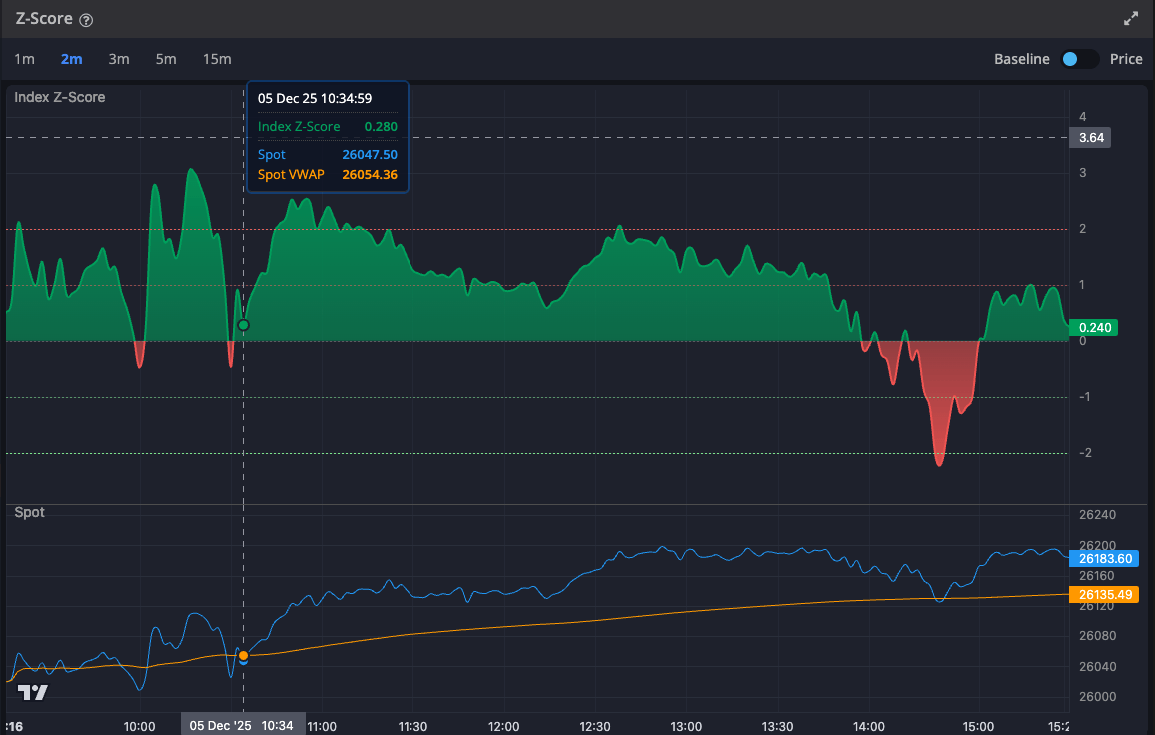

The Z-Score is a statistical measure that tells you how far a value is from the mean, in terms of standard deviations. It's used to identify overbought/oversold conditions relative to historical behavior.

Spot / VWAP

Spot / VWAP Z-Score with STD

Z-Score with STD

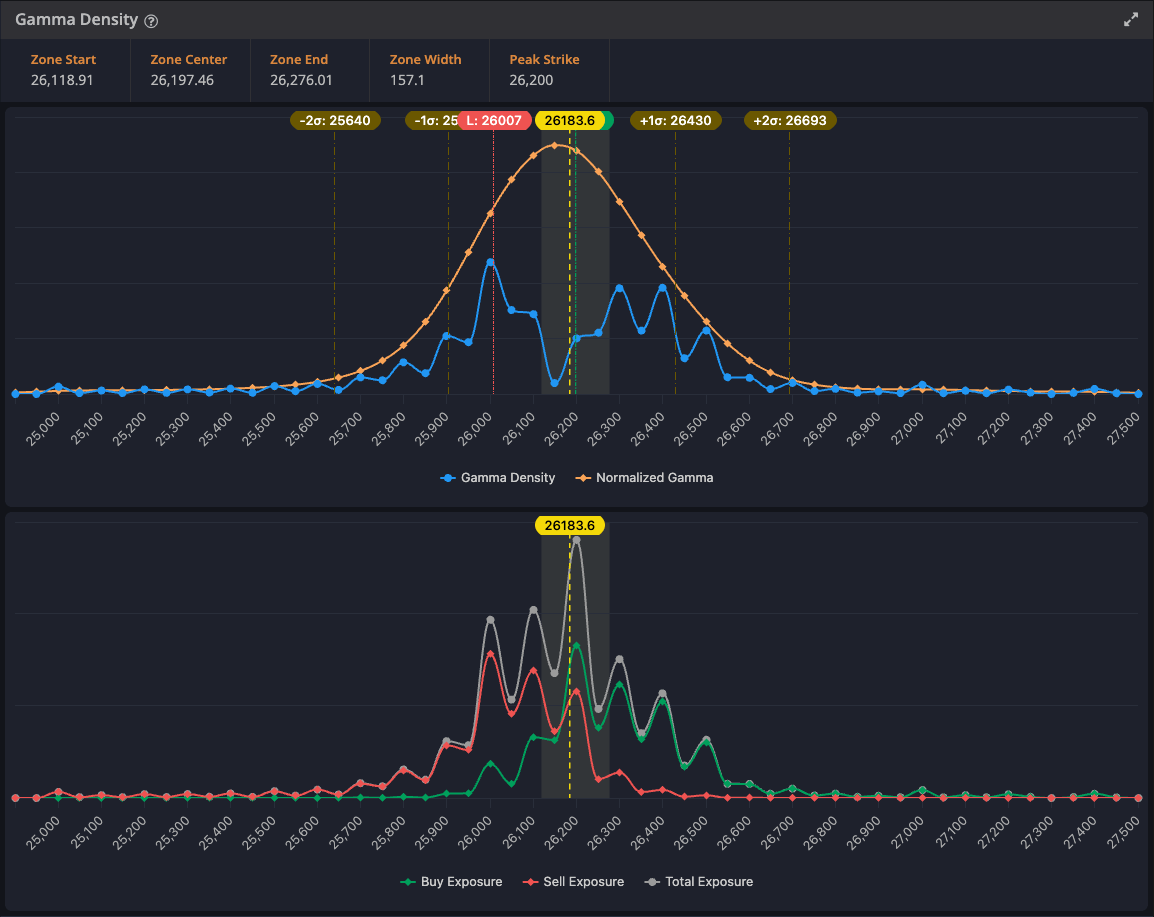

Gamma density refers to the probability density function (PDF) of the gamma distribution, a continuous probability distribution used to model waiting times or non-negative random variables. Its shape depends on shape and scale parameters.

Buy Sell Gamma Exposure

Buy Sell Gamma Exposure Normalized Gamma

Normalized Gamma Day High Low

Day High Low Gamma Zone

Gamma Zone

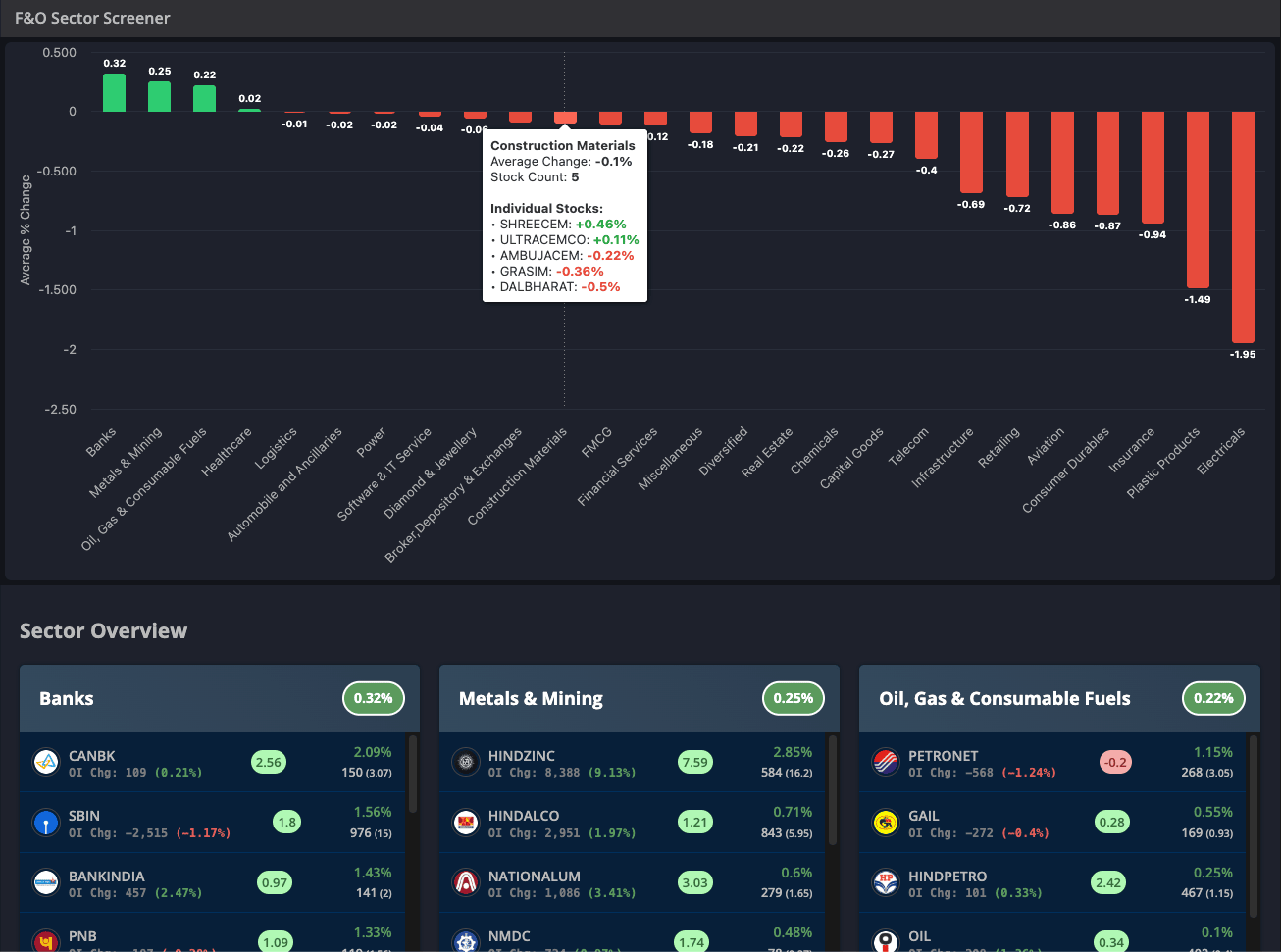

The dashboard showcases a F&O Sector Screener with a bar chart comparing average sector performance. Financial Services, Construction, and Metals & Mining lead with strong gains, while Consumer sectors and Airlines decline. A Healthcare tooltip shows mixed stock performance. Below, sector cards display key stocks with price changes, open interest data, and volumes for quick market insight.

F&O sector stocks

F&O sector stocks Sector wise Gainers / Losers

Sector wise Gainers / Losers Sector % Change

Sector % Change Intraday Boost

Intraday Boost Yesterday Breakout

Yesterday Breakout Today Breakout

Today Breakout RS-Factor

RS-Factor

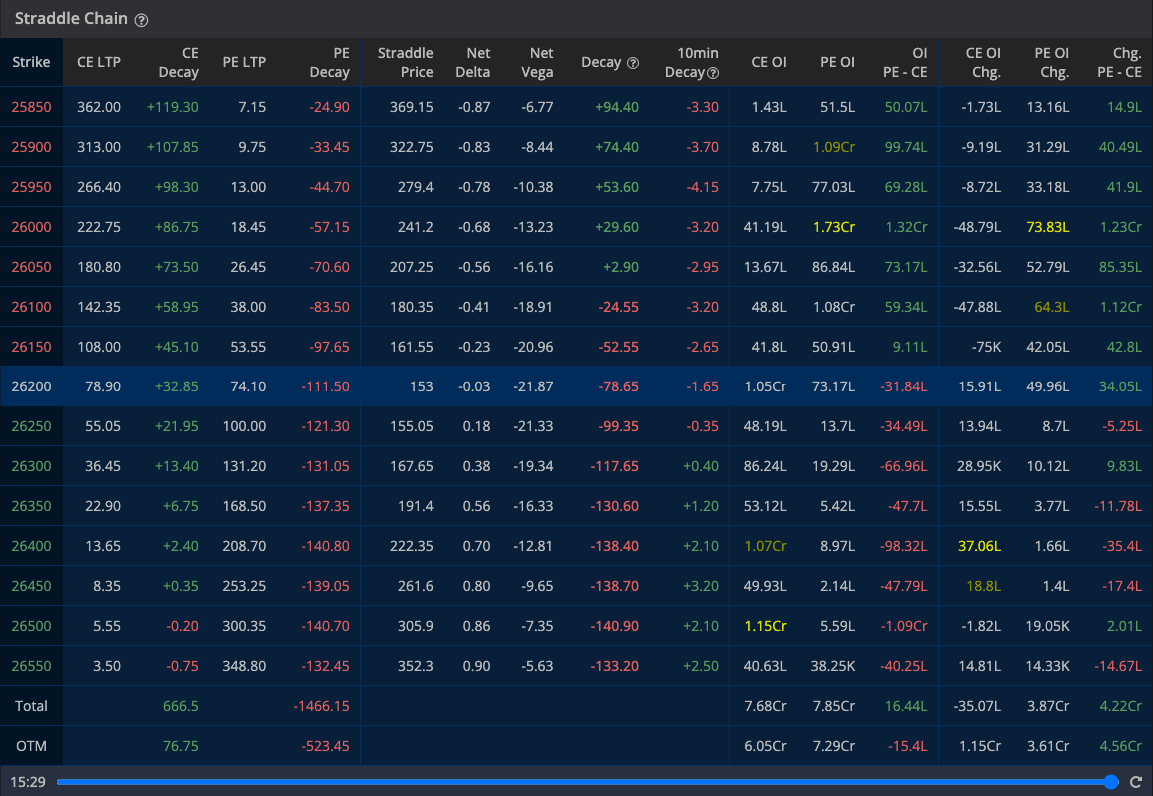

Using the straddle chain approach, an investor takes positions in both a call and a put with the same strike price and maturity date. Total decay, OTM decay and OI also check for CE and PE.

ATM ± 2% straddle

ATM ± 2% straddle Today decay

Today decay Total Open interest and OI change

Total Open interest and OI change Net Delta and Vega

Net Delta and Vega OTM decay and OI

OTM decay and OI

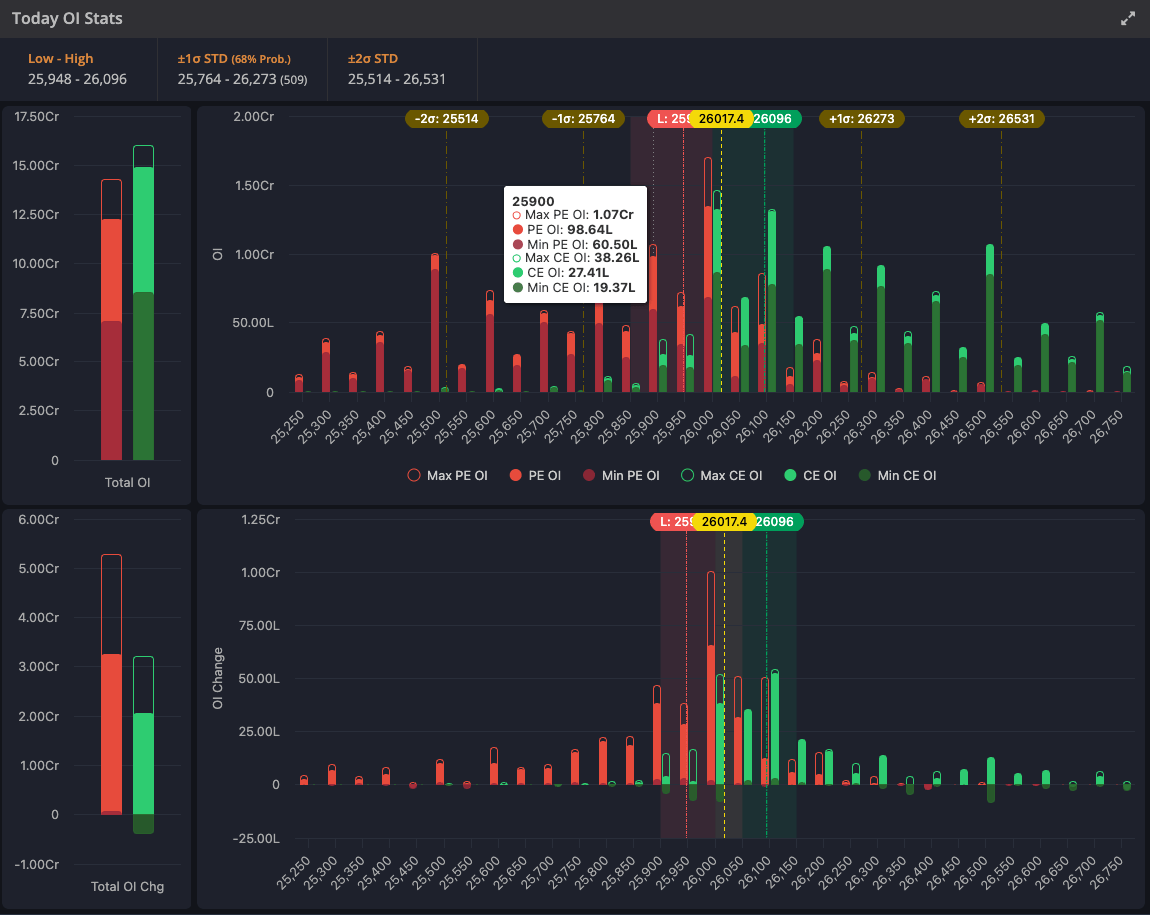

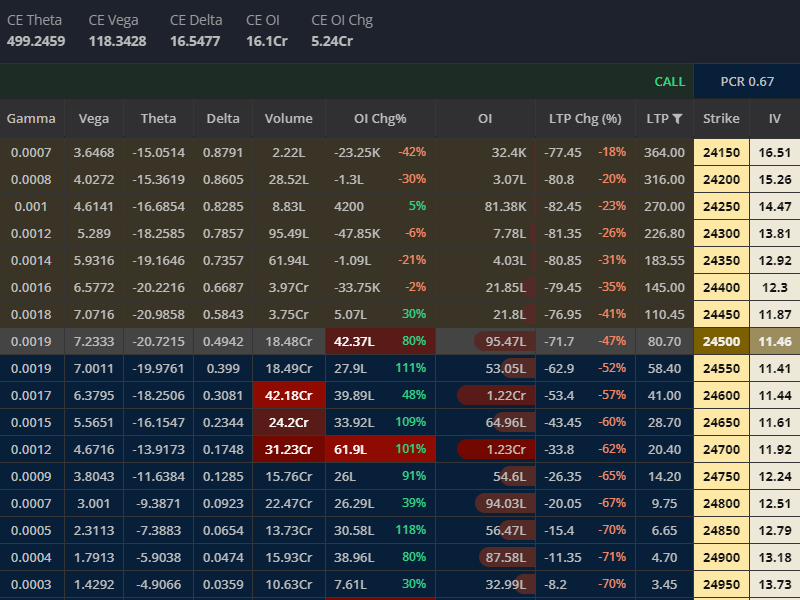

OI Stats offer visual insights into the OI buildup and Unwinding for Call (CE) and Put (PE) options across various strike prices. This helps traders support/resistance zones, and unusual activity.

Total OI and Today OI change

Total OI and Today OI change Today MIN and MAX OI

Today MIN and MAX OI High OI Zone for Call and Put

High OI Zone for Call and Put Day High and Low

Day High and Low 68% probability zone

68% probability zone

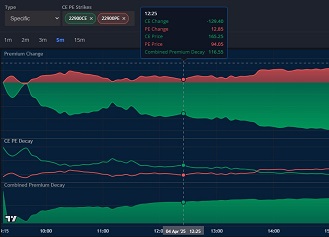

This helps in identifying market trends, sentiment shifts, and potential price movements based on the early trading session's option pricing dynamics.

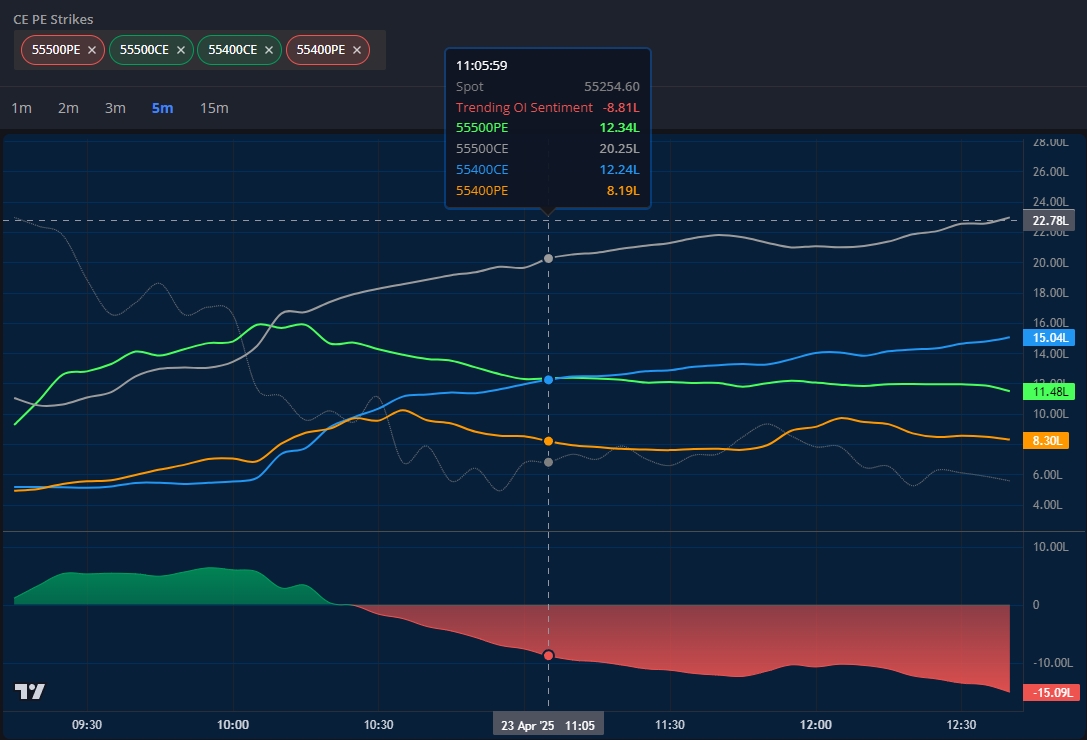

Multistrike OI analysis in Options refers to the analysis of open interest (OI) data for multiple strikes within a particular options contract.

Analyzing ATM IV trends enhances trading skills and improves market direction predictions, providing a better edge for making informed decisions.

We analyze ATM options along with strikes extending 5% on both sides to assess market trends and potential movements effectively.

Volume APEX gives insight into market sentiment by factoring in not just how much was traded (volume), but also how directionally significant those trades were (via delta).

Gamma Exposure (GEX) is the estimated value of gamma exposure that market makers must hedge for every 1% change in the underlying stock's price movement.

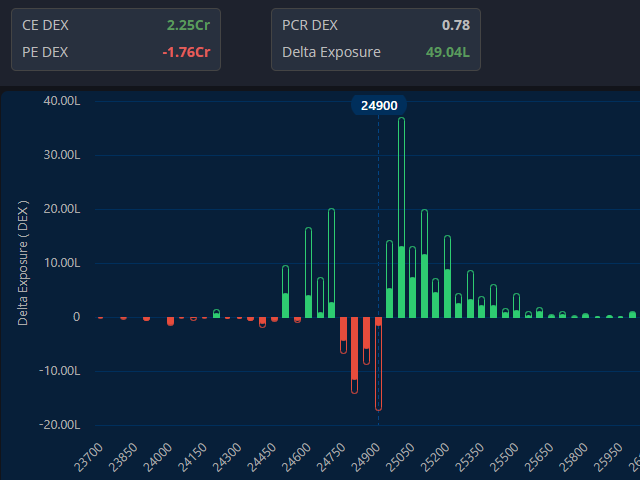

Option dealer delta exposure converts option trading size to an equivalent index volume (bought or sold).

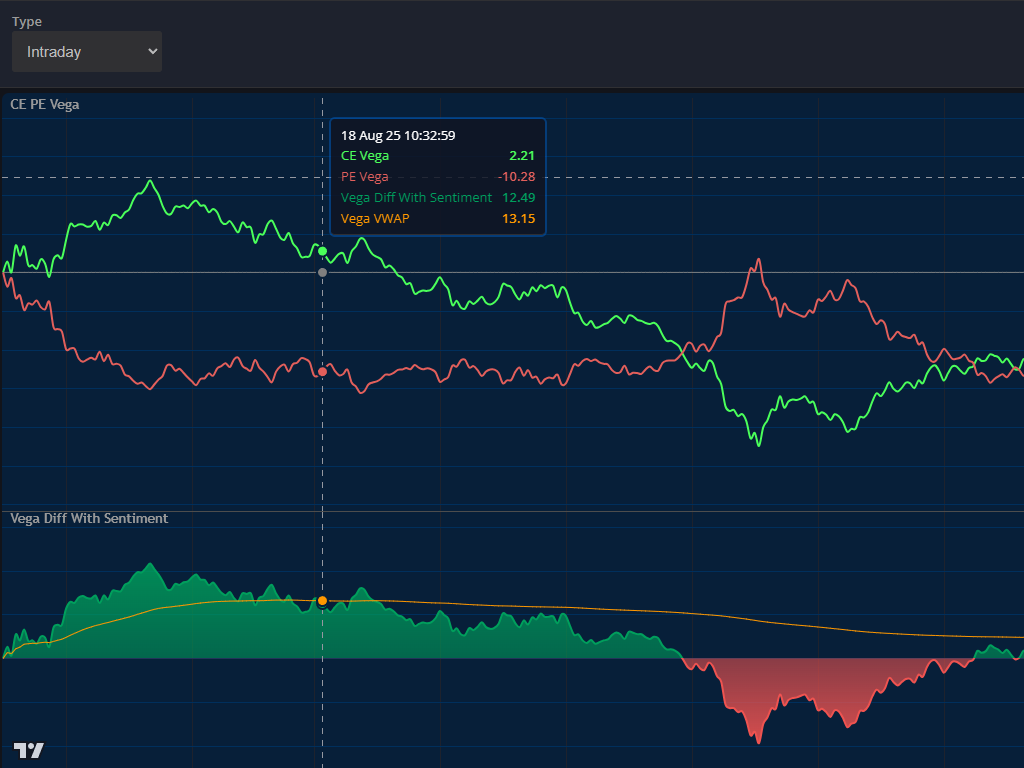

Vega Pulse visualizes the real-time movement of Call and Put Vega, highlighting the volatility sensitivity of options. It helps identify shifts in market sentiment and potential volatility-driven trading opportunities.

Open interest, a key metric in index options trading, represents the total number of outstanding contracts.

OI Stats offer visual insights into the OI buildup for Call (CE) and Put (PE) options across various strike prices. This helps traders support/resistance zones, and unusual activity.

The profit and loss are projections, and they depend on premium, liquidity, IV, delta, vega, theta etc.

On a chart showing CE and PE Open Interest (OI) and price, a rising price with increasing CE OI suggests strong bullish sentiment.

Rolling Straddle with Premium Decay

Rolling Straddle with Premium Decay Straddle - Strangle Charts

Straddle - Strangle Charts Straddle Chain

Straddle Chain Intraday Expiry wise IV Chart

Intraday Expiry wise IV Chart IV Calendar Comparison

IV Calendar Comparison Volatility Skew

Volatility Skew PCR vs Index

PCR vs Index Volume PCR

Volume PCR Volume APEX

Volume APEX Trending OI Sentiment

Trending OI Sentiment Advance Option Chain with Greeks

Advance Option Chain with Greeks Strikes Decay / Premium Change

Strikes Decay / Premium Change Z-Score

Z-Score Vega Pulse

Vega Pulse Scalping Trend

Scalping Trend Net Drift CE PE Premium by value

Net Drift CE PE Premium by value ATM Decay / Premium Change

ATM Decay / Premium Change Market Sentiment with Greeks (Θ, ν)

Market Sentiment with Greeks (Θ, ν) Live Max Pain

Live Max Pain Option Chart

Option Chart Multiframe Charts

Multiframe Charts Volume Exposure (VE)

Volume Exposure (VE) Strike Delta Exposure (DEX)

Strike Delta Exposure (DEX) Net Delta Exposure (DEX)

Net Delta Exposure (DEX) Strike Gamma Exposure (GEX)

Strike Gamma Exposure (GEX) Net Gamma Exposure (GEX)

Net Gamma Exposure (GEX) Gamma Density & Convexity

Gamma Density & Convexity Gamma Exposure Dashboard

Gamma Exposure Dashboard Strike Vega Exposure (VEX)

Strike Vega Exposure (VEX) Net Vega Exposure (VEX)

Net Vega Exposure (VEX) OI Analysis

OI Analysis OIWAP (Option Interest Weighted Average)

OIWAP (Option Interest Weighted Average) Multistrike OI

Multistrike OI Strikewise OI

Strikewise OI Cumulative OI

Cumulative OI OI vs Price

OI vs Price OI Change vs Total OI

OI Change vs Total OI Today OI Stats

Today OI Stats Delta Neutral Strategy (Δ Chart)

Delta Neutral Strategy (Δ Chart) Delta Neutral Vega Positive Strategy

Delta Neutral Vega Positive Strategy Custom Strategy Builder

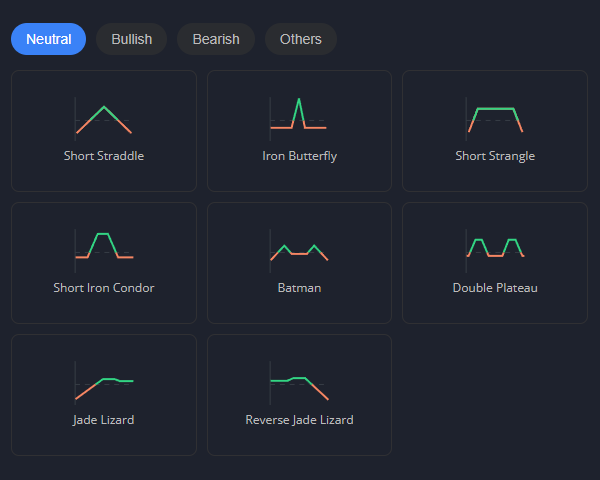

Custom Strategy Builder 36+ Ready-made Strategy

36+ Ready-made Strategy Strategy with Greeks ( Θ, ν, Γ ) chart

Strategy with Greeks ( Θ, ν, Γ ) chart Strategy Supertrend

Strategy Supertrend Strategy RSI

Strategy RSI Strategy VWAP

Strategy VWAP Strategy Strikes OI

Strategy Strikes OI Payoff Graph

Payoff Graph Save Custom Strategy

Save Custom Strategy"This tool revolutionized my options strategy. The Greek calculations are spot on and lightning fast."

"As a beginner, this platform made understanding Greeks approachable. Now I trade with confidence.😊"

"The strategy builder is a game changer. I can test ideas and see Greek impacts in real-time."

We are here to serve you in the best possible way. Do let us know your feedback or your query. We are happy to help you always.

Address: A-1, 2nd Floor, Sunsine Complex, Surat, Gujarat, 394101

Email Us

Everything you need to know about the OptionLab options trading platform and how it works.

The Builder feature in OptionLab is a helpful tool that lets traders easily create and use options trading strategies. It works for both beginners and experienced traders by offering two simple ways to build strategies:

1. Custom Strategy Builder: Users can create their own strategies from scratch by choosing specific options based on their needs.

2. 36+ Pre-Built Strategies: Provides ready-made strategies that traders can use instantly without having to build them from the beginning using greeks chart.

3. As per your strategy you can analysis P&L.